by John P. Pratt

29 Jun 2021, Decision Day (PH), Consecration (UE)

©2021 by John P. Pratt. All rights reserved.

|

1. The Revelation 2. Interpretation 2.1 Modern 2.2 Original 3. Abraham's Tithing 4. Conclusion Notes |

Members of the LDS Church have been taught to pay their tithing, usually understood as 10% of their income, but it is left to the individual to decide exactly what that means. Most understand it to be their total income either before or after taxes.[1] Was that always understood to be what the law of tithing meant? If it is different, has a new revelation been received which explains the difference?

|

The only revelation received and accepted by the LDS Church about the modern law of tithing is found in D&C 119, given in Far West, Missouri, on 8 Jul 1838. It was given in response to a specific prayer asking just how much Church members should pay in tithing. The revelation states that initially member should give all of their surplus to the Presiding Bishop, but that thereafter, the general rule is this:

And after that, those who have thus been tithed shall pay one-tenth of all their interest annually; and this shall be a standing law unto them forever, for my holy priesthood, saith the Lord. — D&C 119:4

That is it! One very short, simple statement. How could that be misunderstood? Tithing is to be paid at least once a year in an amount equal to one tenth of one's annual interest!

Let us now see how that simple statement has been interpreted by the modern LDS Church.

There is vast difference between how this simple definition of tithing was originally interpreted compared to how it is interpreted today. Let's look at both.

|

The simplest statement we know of is the statement of the Lord himself, namely, that the members of the Church should pay "one-tenth of all their interest annually," which is understood to mean income. No one is justified in making any other statement than this.

— First Presidency Letter to Church Leaders (19 Mar 1970).[2]

Here the First Presidency is totally conservative and safe! Right?? They quote the original revelation verbatim, so who could argue with that?

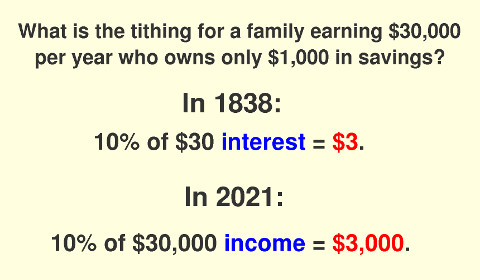

But, wait, there is a huge interpretation of one word given. We are told that the word "interest" should now be understood as "income". Why is that? Has the word changed in meaning since 1838? After all, there is a huge difference today in what a person considers to be "interest" earned in a year versus their "income" earned for a year. Let us now look at the original interpretation of the law of tithing.

In 1838, when the revelation was given, what was the understanding of the meaning of the word "interest", on which the members of the Church should pay their annual tithing? Fortunately, that is now known precisely, because a letter has been found in the Joseph Smith papers from the Presiding Bishop Edward Partridge to Newell K. Whitney, which explained his understanding of the new revelation. The letter is dated 24 Jul 1838, shortly after the revelation was given earlier that month.

In that letter, Bishop Partridge provided a very simple example of his understanding of the new law of tithing:

"If a man is worth a $1000, the interest on that would be $60, and one/10 of the interest will be of course $6."Today that would likely mean that tithing should be "10 percent of what Saints would earn in interest if they invested their net worth for a year."[3] A typical interest rate at that time was 6% per year, as clearly implied in this example. If so, then tithing was based on one's net worth, not one's total income. That net worth would increase as one's discretionary income was used to invest or improve his property, but it is definitely not tied to expenditures for basic requirements for living, such as food, clothing, taxes, or medical costs.

Thus we see, that the word "interest" meant exactly the same thing in 1838 as it means today. A man who had $1,000 in a savings account might earn $60 interest on that money and then would be expected to pay 1/10 of that interest, being $6, to the Church as tithing.

But wait!! What about that man's entire income during that year? That was not even mentioned in Bishop Partridge's letter. In 1838, most members of the Church were eking out an existence just to keep alive amidst all of the persecution. They grew much of their own food and often bartered. The point of this example, however, is not imply that no tithing was paid one's income during the year; the point is that the word "interest" was understood exactly as it understood today. Moreover, the word "interest" back then most likely would have also included any overall "increase" in person's wealth, even as it would also mean that today. That meaning was probably implied in Partridge's letter as being included in one's total net worth.

For example, a rancher would pay tithing on the increase in his net worth annually also. If his herd of cattle increased over the year by 100 head, then he could sell 10 head and pay the proceeds as his tithing on the increase of the herd. That would be a form of "interest". Farmers would not know what their increase was until the end of the year, hence their tithing could be paid annually. That one annual payment has today turned into what is called "tithing settlement" in the LDS Church, which also includes the purpose of paying on annual investments.

|

Immediately after the martyrdom, in August 1844, the Quorum of Twelve changed the meaning of tithing to be 10% of one's annual income, substituting "income" for "interest"! Shortly afterward, the Twelve exempted themselves from needing to pay any tithing at all! Brigham later admitted that "neither he nor anyone else" had actually paid according to his new interpretation.[4]

One the other hand, the Reorganized LDS Church (now Community of Christ) apparently has kept the law as they had understood it in Joseph Smith's day:

"New converts are expected to prepare an inventory to establish their net worth. Their initial tithing entails a tenth of this net worth, which can be paid at any time. Members then pay their tithing annually, calculated by taking their gross income, subtracting their basic living needs and turning over to the church ten percent of the remainder."[5]This definition is in the spirit of tithing one's "interest", meaning "increase", "surplus", or perhaps what the US government today defines as "discretionary income": "Discretionary income is what a household or individual has to invest, save, or spend after necessities are paid."[6]

One modern restoration group claims a new revelation from the Lord which verifies a similar interpretation. It states that tithing was never meant to establish a wealthy general fund nor to invite the wrongful accumulation of wealth that has resulted from the long abuse of this law. "The law was to be a light thing, easily borne by the faithful. Tithing was always to be taken from surplus (meaning unnecessary excess property) and increase (meaning what remains after all costs of the household have been paid). It was to be drawn out of the abundance in the possession of the giver so that there may be enough and to spare, not from property required for their necessities."[7]

Is there any witness in the Bible of a precedent for the concept of paying tithing only on one's excess above one's basic living expenses?

|

And Melchizedek king of Salem brought forth bread and wine: and he was the priest of the most high God. And he blessed him, and said, Blessed be Abram of the most high God, possessor of heaven and earth: And blessed be the most high God, which hath delivered thine enemies into thy hand. And he gave him tithes of all. — Gen. 14:18-20 (KJV, emphasis added).

Thus, it is clear that the principle of tithing was known long before the law of Moses, but this account does not provide the basis on which that tithing was calculated. It is known that the meaning of the word "tithing" refers to "one tenth", but one tenth of what? This account seems to imply that Abram paid one tenth of all of the spoils of the war, even though he had an army of 318 to feed (Gen. 14:14).

Fortunately, we have two witnesses from modern revelation which clarify the basis on which Abraham calculated tithing!

First, the inspired version of the Bible provided by the Prophet Joseph Smith adds the following clarifying verse:

Wherefore, Abram paid unto him tithes of all that he had, of all the riches which he possessed, which God had given him more than that which he had need. — Gen. 14:39 (emphasis added).

Thus, the important clarification is included that Abraham's tithing was based on being one tenth of all surplus or excess of that beyond which he had need. As we have seen above, for those who are poor that difference is huge, because it means that if they lack for the basic necessities of life, that there may be no requirement to pay tithing at all! Instead, they may receive from the Lord's storehouse from the tithing of donations from others.

The Sealed Book,[8] having recently been translated from the first few of the sealed portion of the Plates of Mormon, provides a second witness to this basis of the calculation of Abraham's tithing:

And this Melchizedek, having established righteousness on earth, was called the king of the heavens by his people, or, in other words, the King of peace. Because he lifted up his voice, and blessed Abram, being the high priest and keeper of the Lord's storehouse, the one that God appointed to receive tithes for the poor. So even Abram paid him the tithes of all that he had, which God gave him, which exceeded his needs. — Sealed Moses 9:11

Thus, we have two witnesses from modern revelation that Abram paid tithing on the excess he had beyond his needs! This is indeed in harmony with the revelation given to Joseph Smith about tithing to be paid on "interest" or "surplus", not on one's total income as taught by the modern LDS Church, beginning in the days of Brigham Young.

The law of tithing given to the restored Church of Christ was understood in the days of Joseph Smith to be ten percent of annual interest, increase, or surplus, not from money required for the necessities of life. That has been verified by the recent publication of a letter from the first Presiding Bishop explaining the original understanding.

The true concept of what was to be tithed was changed by Brigham Young to require 10% of one's total income, whereas the Reorganized LDS Church kept to the original concept. That has led to the LDS Church greatly overcharging its members, resulting in the Church wrongly having accumulated vast sums of wealth at the expense of the faithful poor having suffered from paying such a disproportionately large sum from their meager existence.

The true meaning has also been revealed in both Joseph Smith's inspired version of the Bible and in The Sealed Book that Abraham actually paid tithing only on what exceeded his needs. This shows the need for modern revelation to clarify confusing points in the Bible.

Knowing the original and true concept shows the love and mercy of the Lord in requiring from His Church only from their surplus, with which He has blessed them, to pay for necessary expenses of the Church and to help ensure there are no poor among the people of God.