Affordable Housing

by James F. Pratt

Builder Background

My name is James Pratt. I have a degree in physics and my career started as a member of the lunar launch team in 1966 that put the Surveyor vehicles on the moon prior to the manned landing. I calculated the mid-course correction required to have the lunar vehicle hit the desired target and was rated in the top 3 of a 25 man team.

When that program ended I returned to Utah and found an opportunity to become a residential builder. I started a company that became one of the top three homebuilders in Utah in volume of sales. I specialized in low cost entry-level, energy-efficient homes.

We built homes that would sell out before competitors in the same location could make any sales. Other builders would commonly come to our site and pace off our new plans to copy them. Also our subcontractors that worked on the homes would buy them themselves. They liked the plans and they liked the work they saw being done on each home. They also knew that their work would be under scrutiny by their new neighbors, and they knew that their work was good and that was the reason they were hired in the first place. Everybody was happy. We never had a single complaint filed against us.

As a homebuilder, I was selected by the Homebuilder's Association of Utah to represent all builders in writing the State Energy Code. I served on a committee that drafted the legislation. The local FHA office also came to me and asked me to enter a design in a national FHA competition to design a solar home. They thought it would be "a feather in Utah's cap" to show the national office what we could do. The design I submitted won the competition and received a cash grant. I also served on the Utah Solar Advisory Committee for over a decade to recommend policies and strategies to the governor and legislature.

In 1972 I was offering finished homes for $14,900 and I watched the price escalate to $84,000 in 1982 for the same size home. Now it is about $230,000, over fifteen times the price. I now live in Park City and it's even worse here. As I have looked at the situation, I said to myself that there must be a better way.

Historical Perspective

The way most of the world builds a home

The early settlers in America joined together to help each other. They would build homes that they could afford without contracting debt. They would start small, then add to the structure as time went on and they could afford additional expense. The structures were simple but adequate and families were raised. Most of the world follows this path.

My father grew up with 15 brothers and sisters in a little two-room home. They worked hard and all turned out fine. My father's assignment was to get up early every morning and start the fire in the wood stove to heat the home.

The way we do in America

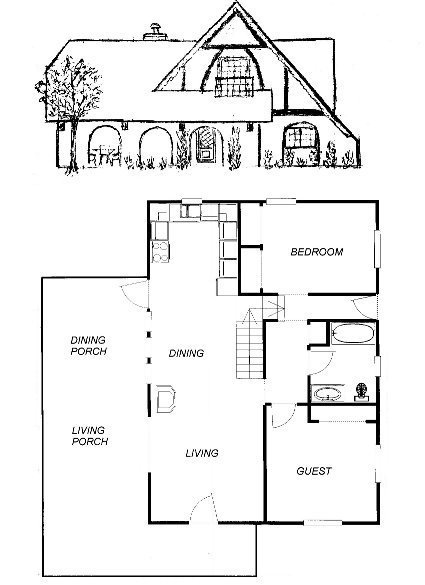

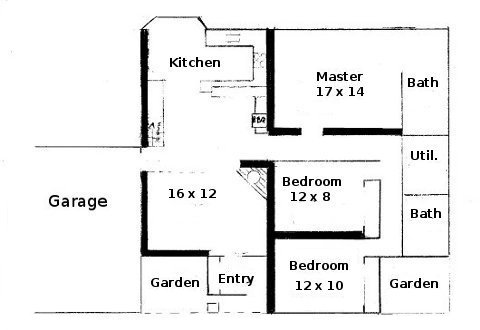

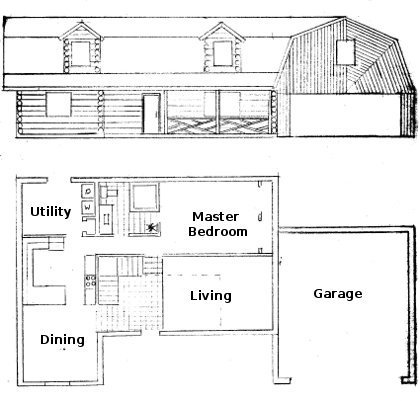

|

A Pratt house plan (774 sq. ft., about $31,000)

Well, you know how we do it now in America. Everybody finds the maximum debt they can carry, then buy the biggest house that they are allowed. They would buy bigger if they could. Then they generally yearn for (covet?) the things they could not borrow enough to obtain. There is little patience to wait till later, or until something can be paid for in cash without going into debt.

(Is this a people that can return to build a holy city?)

Problem of Debt

The Role of Debt in Housing Costs

The availability of debt (commonly called credit) amortized over long periods of time (such as 30 years) is a recent development and has allowed a tremendous increase to occur in the cost of housing. If that large debt was not available to the average homeowner, the price of housing would not be able to exist at its present levels.

In most parts of the world people build their own simple structures without borrowing money. Wherever people can borrow, they are convinced to go into debt without realizing its consequences.

Self-Liquidating Debt

An example would be a truck that is purchased for a delivery business. The owner makes more money with the truck than without it, and the truck essentially pays for itself and gives the owner extra income. This type of debt is totally different than buying a big truck just because you want to have it and that you have to pay for from some other source. That makes your wealth disappear in the amount of the cost of the truck, interest paid, repairs, maintenance, insurance and depreciation. Most people, seeing the total cost of such a purchase, realize the seriousness of their mistake, but only after they have lost a lot of money. However the owner of the delivery truck is increasing his wealth and will be looking for ways to buy more, but that is another story for another time.

Although debt for a home is normally not a self-liquidating debt, the principle still exists that an expense that lowers your overall cost is a good decision. If you pay cash up front, then your initial cost is higher and you do have a 'payback period' before you break even from lower monthly costs. If you pay by mortgage debt, then you need to look at your overall monthly outlay, not just the mortgage payment alone.

Life Cost

Most people go for the lowest cost on a given item. However they make the mistake of not adding up all the hidden costs of a home, just like the example of buying a truck and not considering the true total cost.

The extra costs for a residence can be insurance, repairs, maintenance, taxes, water, sewer, electricity, gas and landscaping. All of these will be costs that need to be included.

Sometimes spending a little more money on the structure and increasing the mortgage payment $20-$30 per month will save much more on utilities, insurance, maintenance and even taxes. If savings exist starting the very first month there would be no "years to break-even ". A buyer would be saving money the day they moved in, based on total monthly expenses. This is more difficult for a cash buyer to do, since he has to pay the higher cost up front, but it is still generally a good idea to do it since it lowers the life cost of ownership.

Results of Long Term Debt

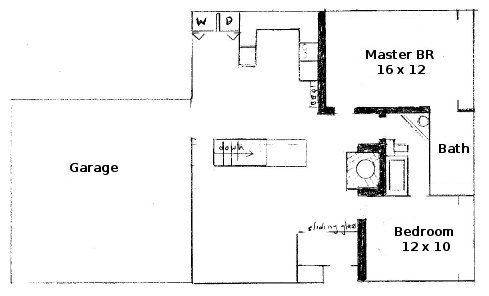

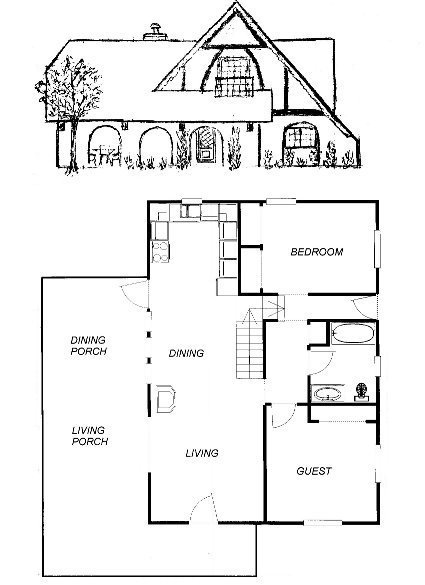

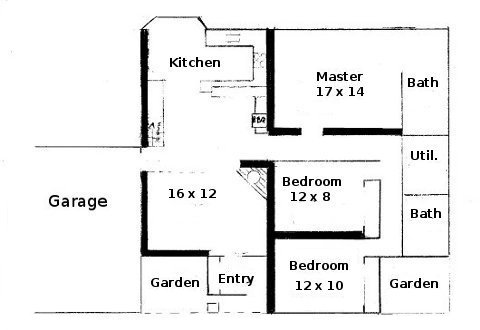

|

A Pratt house plan (962 sq. ft., about $38,500)

A person that wants a big expensive home right away when they get married are forced to enter into a contract that appropriates their wages for most of their life. They will give most of their paycheck for 30 years or more and smile and think they have achieved their hearts desire. They will pay approximately three times the actual cost of the home that is represented on the papers they sign. At the end of the thirty years they find that they have a 30-year old home and that is not desirable or socially acceptable, so at some point they decide they need an even larger home, and again sign a long-term debt document, since that is what everyone else does. It is called the American way.

The Worst Part

Henry Ford had to finance large amounts as he grew his motor company. If you think you understand our monetary system better than Henry Ford, you probably are in error. Henry Ford said that if the American people understood the corruption in their monetary system, there would be a revolution before morning. Note he even said 'before'. People would not even wait until the next day if they understood how they were being intentionally cheated by absolute lies and fraud. It is not complicated, it is very simple. It is made to seem complicated so that most people think it requires geniuses and don't even try to look at it.

The part that makes borrowing the money so bad is that the entity that you think is loaning you the money to buy your home actually doesn't even have the money. It has not earned the money, the money is not on record, but is fabricated at the time you think you are borrowing it, just like printing the dollars in the back room before they give them to you. Then you pay interest to them for thirty years on money they didn't even have. That is a fraud beyond comprehension. Understanding this would indeed cause "a revolution before morning ", but that is also another story.

The Bait

One of the ruses that takes most of a person's earnings is the idea that they need to have a home that they actually can't afford. This is reinforced since no affordable choices are presented and they know they need a home. Thus people become willing to sign away their future earnings. The costs of a home are driven up through regulations and codes (I used to write them) so that a family cannot even afford the cheapest house without going into debt. This only exists in the so-called 'developed' countries, and we pride ourselves on it here in America. Since everybody does it, it seems normal to us, much as slavery appears normal to a slave on a plantation. No other choices are presented.

The Error

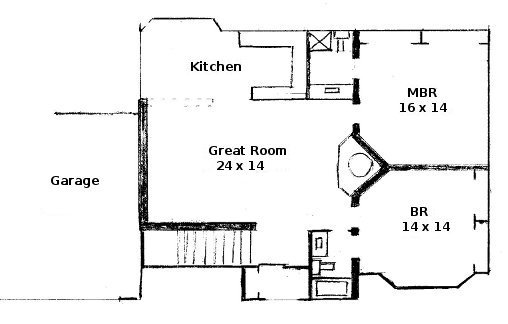

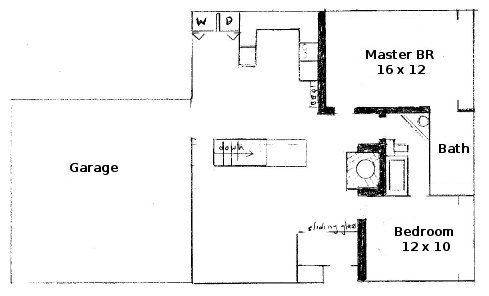

|

A Pratt house plan (1080 sq. ft., about $43,000)

The price that is paid for wanting something before you can truly pay for it is a lifetime of slavery that gives your earnings to someone else. In the case of a home, the largest purchase you will ever make, you pay three times the actual cost, which represents most of your lifetime earnings. This money goes to someone else, not your family.

In addition, because you want something new, as your home gets paid off you notice it is now an older home, so you sell it and but another newer home and repeat the same cycle over again, giving most of the fruits of your labors to an entity you don't even know.

Economic Difficulty

In difficult economic times, jobs are lost, homes are foreclosed, and taxes to municipalities go unpaid. A district can have trouble paying its employees, such as California these days. If a serious problem develops with a water district and water is cut off, what is the value of the homes in that area? What do the families that live there do? Can they sell? The future that you planned on can disappear in an unforeseen way.

Summary

- We have been led to believe that we should be able to have things we cannot afford.

- Home prices have gotten out of control. The average individual cannot afford the average home.

- Means have been given us to assume large debts to pay for these things.

- We work our entire lives to pay interest on a large debt

- The money we pay interest on never actually existed before we 'borrowed' it.

- It would be nice to have an alternative to going into long-term debt which amounts to slavery working your life for someone else.

A Solution

An Old Answer

Looking at a different approach, if a young couple started with a simple home that they could pay for and build with a little help, they are able to keep the earnings from their work. They can apply those each year to expand and improve their home. In ten years they can spend the same amount of money on their home and it will provide approximately the same home that they would have purchased earlier, but it will be completely paid for, relatively new, and they can keep the earnings from their labors for the next twenty years and more, which amounts to most of their life.

Reducing Construction Costs

Every step and component of a house was examined to find the cheapest way to produce it or to even eliminate it if possible.

All the skilled trades were eliminated except for five: plumbing, electrical, gas line, countertops and carpet laying.

The construction process is simplified so that the owner with a few friends can build the structure in about three weeks. If the owner wants to hire the work done, he can employ unskilled labor instead of paying a premium for specialized skills.

Reducing Life Costs

Use of effective insulation and proper design and orientation on the site provides a plan that can be heated by the sun and a small wall furnace and cooled with a small evaporative cooler. This reduces the fuel requirements to a fraction of a normal house, but also provides reasonable comfort even if fuel is unavailable.

Use of fireproof materials and earthquake-resistant construction can lower insurance costs.

Design

The designs should emphasize light, openness and air circulation, although the final decisions are certainly made by the owner.

We recommend paying attention to:

- BEAUTY

- REJOICING

- SINGING AND DANCING

- WORKING WITH LIGHT AND WIND PATTERNS

- SAFETY AND SECURITY

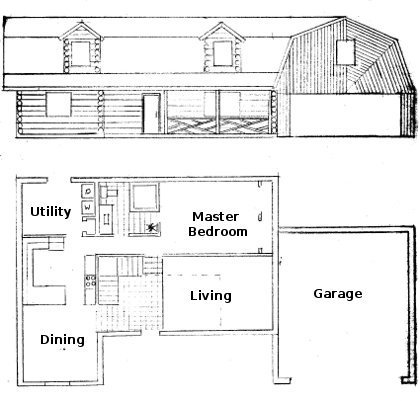

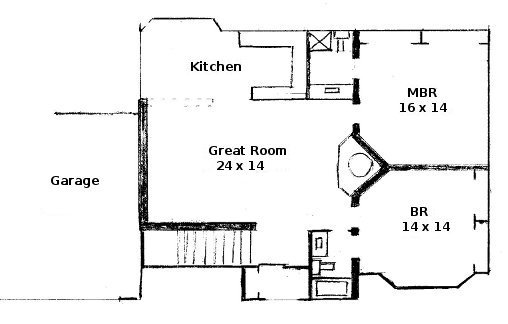

|

A Pratt house plan (1160 sq. ft., about $46,500)

Protected patios and walk-out areas are suggested. They add to the quality of life and add openness and usable space that does not have to be built as a high-cost interior space. They can be protected against fire, wind, earthquake and flood, as well as assault.

Any Plan

This simplification can be applied to essentially any floor plan. It is the method of construction that matters, not the size or style of the structure.

There is quite a bit of flexibility even in the simplification. The owner is not restricted to just one method. For example the walls can be framed conventionally with standard lumber or they can be built with straw bales, adobe, rammed earth or foam block or combinations thereof.

Code Compliance

Compliance to the IBC is judged by the local building official as to whether it is "equivalent " to what is specified in the IBC. Most officials seek the protection of a professional engineer by having him certify and stamp the plans as being equivalent. However some officials protect themselves by not allowing any deviation at all. By way of example, Summit County has stated they have rich people with a lot of power who will get somebody fired if anything unusual is built in their sight and they don't want any part of something new. The Duchesne County building official states that lower cost housing is greatly needed and is very helpful in helping it progress. That represents a pretty good idea of the range that can be expected between jurisdictions.

If you are interested in a certain jurisdiction, locate the name and phone number of the head building official and give it to me. It is probably better for me to make contact and show my credentials to introduce the project in a strong and positive way, rather than an uncertain potential owner that doesn't understand the answers that are required. Most jurisdictions should grant approval.

For example, Mr. Ron Ivie is probably the most knowledgeable building official in the state. He works for Park City, which is in Summit County. Mr. Ivie looks favorably on these ideas and is willing to approve a good set of plans, and being within a city jurisdiction, he has that authority, without having to get the approval of the county officials who are afraid for their jobs and will not approve anything new.

So you need to find the official who has jurisdiction over your specific property.

Engineering

|

A Pratt house plan (1172 sq. ft., about $46,900)

The concepts were presented to a professional engineer. His initial response was "No way, this can't be done ". At the end of the discussion he was enthused and willing to sign off on most of the innovations. There are some ideas that still need to be field tested and we will be the first to try them to see how well they work, but those concepts are not a necessary part and can be deleted without affecting the general thrust of the effort.

Estimated Cost

Currently the target price for the direct costs of construction to build a new home are $40 per square foot, which compare to an equivalent modular construction price of about $120 per square foot for a structure including a foundation but with no municipal fees. Generally site-built structures are more expensive than modular, so the savings are even greater.

New Details

Foundation

The expensive concrete and steel foundation and floor were eliminated. The weight bearing footing is crushed rock such as holds railroad ties and tracks. They have supported trains weighing far more than a house for more years than most houses stand. Frank Lloyd Wright built his homes on this type of foundation. The walls are held in place laterally by concrete piers set in the ground.

HVAC

The heating and cooling systems were greatly reduced. No hot-air ductwork is required, also no whole-house furnace or air-conditioner. Cooling can be provided by a small evaporative cooler that works off its own solar panel in the summer, which is obviously ideal since it will only be hot when the sun is shining.

Interior

Sheetrock was replaced by paneling. The interior of the house can have a conventional look acceptable to the taste of the owners. Again, thicker walls can influence the decor, notably in wider ledges or even seats in front of windows. These are ideal for flowers and plantings.

Safety & Protection

The structures can resist fire, earthquake, high winds and flood, generally better than conventional construction.

Specifics

- The normal foundation of concrete and steel is eliminated.

- The concrete slab floor is eliminated.

- The exterior walls can be selected by owner preference: pole, slab, lumber, straw bale, adobe, rammed earth, cob, cordwood.

- Insulation-straw bale, EPS foam, fiberglass, cellulose, rock wool

- Earth berming, sand, gravel and tile are used for thermal mass to minimize indoor temperature swings.

- Underground designs with light and ventilation,

- Design — passive solar, good insulation, higher ceilings, glass, thermal mass

- HVAC — can be eliminated.

- Water, sewer, septic — plan for independence or not- grey water, black water, compost

- Sheetrock and paint — eliminated

- Air quality — indoor plantings can improve air quality and ambience.

Location

Primary Residence

If the structure is to be the primary residence, it does not make a lot of sense to build a $40,000 home on a $200,000 lot, so there is a need to be more remote to save land cost, but then there is commuting long distances to a job, which is not an acceptable solution. A person would need to find a job or business that can work in the remote location in order to have a primary residence there.

Remote Retreat

|

A Pratt house plan (1384 sq. ft., about )

Because of the problem of work, people generally choose to develop a secondary remote location that they hope to use if things degrade in their normal neighborhood.

When a recent hurricane threatened Houston, everyone tried to get out of town at the same time. The freeways were gridlocked. No one was able to leave. To be successful, one needed the foresight to evacuate before the danger and need to evacuate was announced.

Therefore some practical problems are:

- What is the trigger that will cause me to leave?

- If I am wrong, will it be too late to get to my retreat?

- Am I prepared to disobey civil restrictions intended to keep me in place? Will I be successful or will I be sent to a detention facility?

- I have no practice at living in the remote location

- I have inadequate supplies cached when actually used.

- No network established to renew supplies

- Will the problems that affected location #1 also hurt location #2?

Stakes are provided specifically as a refuge in time of calamity. Why is one choosing to go it on one's own? Counsel is generally given to stay put. Is the new stake preferable?

These kinds of questions should be considered when trying to establish a remote retreat. Those will not be addressed here, but it should be kept in mind that nothing is easy, and location may be the hardest of all.

Our Results

Developed some plans, rich people liked them for rentals, but lost their money before they could proceed.

Normal people with $40,000 wanted to make a down payment on a $400,000 home. Nobody wanted to build a simple structure that was paid for.

So here we sit with a concept that nobody wants.

How we can help - What We Do

- You can be your own general contractor

- We will do what you can't

- Provide simpler construction methods

- Significant savings in labor and materials

- Target of $40/s.f. cost for completed structure

- Obtain required approvals for permits and codes

- Consulting to find special answers

- National awards in solar applications

- Experience in cost-effective housing and budget control on hundreds of homes

- Subcontractors working on our homes decided to buy for their own home

- New ideas in design

- Cost comparisons of different construction methods

- Plan review

- Some locations available for like-minded people